Details of the first monthly REPO auction announced on May 14 and due on May 25 were the most important part of Bank of Russia Governor Elvira Nabiullina speech during Friday press conference. The auction’s volume will be 500 bln roubles, roughly the average volume of “fine-tuning” auctions in recent months. Going forward, the volume will be announced on the eve of the auctions and will depend on the level of liquidity in the banking sector.

This scheme is now very important for banks, given that the structural liquidity surplus decreased to 1.2 trln roubles in April (-1.6 trln roubles year-to-date) due to the outflow of deposits and growth of mandatory reserves (Sberbank's spending on reserves amounted to 242 bln roubles over the last four months). Therefore, it will contribute to a smoother distribution of liquidity in the banking system and strengthen the banks' capacity to restructure loans. The CBR does not expect inflationary pressure to pick up due to provision of additional liquidity, as all surpluses may be sterilised using available tools.

The CBR has reiterated its commitment to further monetary policy easing. Probability of a 100-bps rate cut, to 4.5%, in the next scheduled meeting, is less than 100%. There is no need for emergency rate meeting at present. The neutral key rate would be defined so that inflation equals 4%. The regulator believes there’s no need for negative real rates in its base case scenario at present.

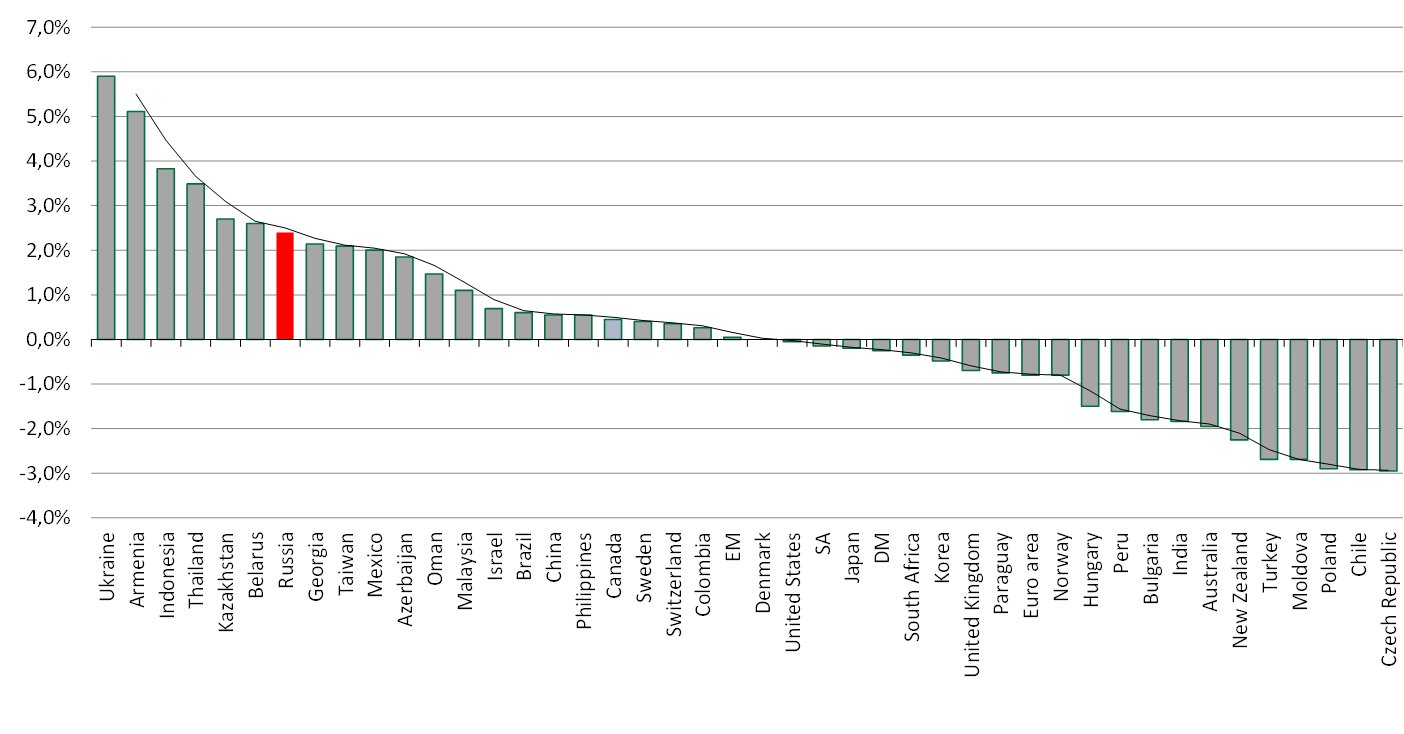

We stick to our projection of a smoother rate cut, no more than 50 bps, at the June meeting and our year-end estimate remains unchanged at 4.5%. The rate cuts made recently by the central banks in Turkey, Mexico and Brazil did not exceed 50 bps, as more than half of the developing countries have switched to negative real rates. Now the CBR’s key rate cuts and target are similar to those of the Bank of Mexico.

The OFZ market reaction last Friday to Nabiullina's speech was poor, as it still was consolidating.

The CRB said inflation acceleration has stopped. Against the backdrop of prevailing disinflationary factors, weekly inflation was about zero and annual inflation was stable at a bit higher than 3%. The impact of inflationary factors turned out to be weaker than initially expected. The central bank's year-end consumer price index (CPI) forecast is 3.8-4.8%. For a more accurate estimate, it is necessary to wait for the end of the lockdown. The peak of annual inflation may come in summer. No tangible inflationary effect is expected from payments of 10,000 roubles per child as part of state support. Going forward, inflation may fall below 4% in 2021-2022 with no monetary policy easing.

OFZ yields dropped to record lows. This will contribute to overall rates’ cuts in the economy. The CBR sees some room to increase government borrowing but does not plan to rely on this source in the long run. Russia’s borrowing growth rate remains lower than in many countries, even despite the record OFZs sales at the auctions on May 20 (169.6 bln roubles). Russia remains one of the least leveraged countries in the world in terms of public debt.

Suspension or major changes in the budget rule are not considered. Only certain adjustments are expected due to a significant shortfall of non-oil and gas revenues and the need to finance temporary anti-crisis measures.

There are no plans to ease H6 and H25 banking requirements (concentration of risks of major borrowers). Elvira Nabiullina will hold her next regular briefing on June 5.

Source: Bloomberg, ITI Capital