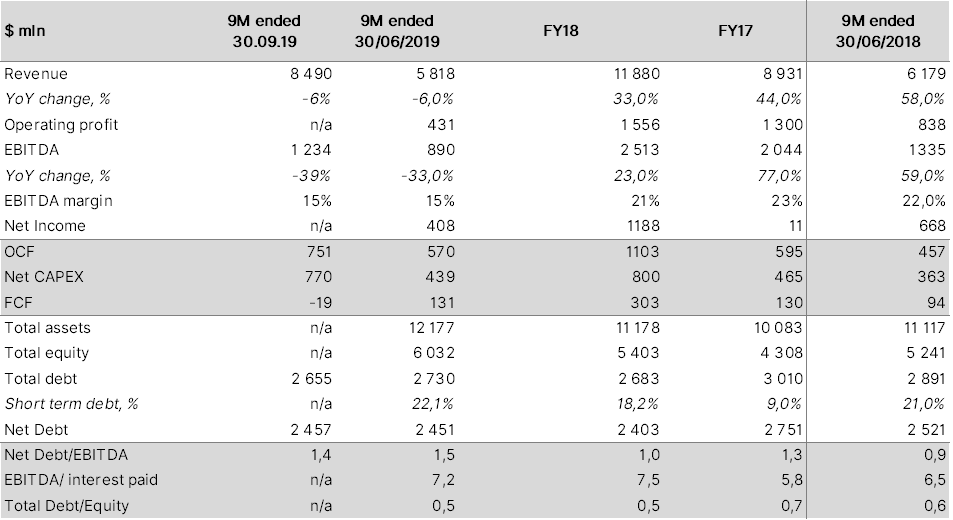

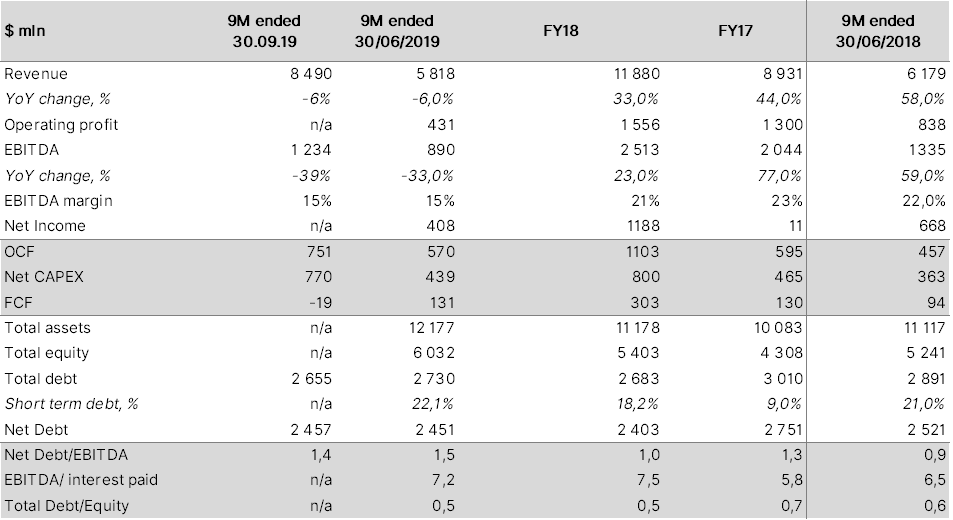

Metinvest B.V., the parent company of steel producer Metinvest, has released its audited IFRS consolidated financial statements for the 12 months ended 31 December 2019. The results look rather weak, reflecting a material deterioration of the credit profile in July-December 2019:

- Metinvest’s consolidated revenues decreased by 9% to $10.76 mln. The metallurgical segment lagged behind and posted a 13% sales drop amid unfavourable prices and falling sales. The decline was partially offset by a 14% revenues growth in the mining segment. In 2H19 the company posted a bigger revenues drop (-15% to $4.9 bln) compared to 1H19. The local market share in the revenues structure was unchanged at 29%

- The company saw a steeper margin drop. In 2019, the consolidated EBITDA margin dropped by 10 pp to 11%. Lower average steel prices, higher spending on raw materials, the negative effect of the hryvnia’s appreciation against the US dollar (+12% in 2H19) have affected operating efficiency. The metallurgical segment’s EBITDA turned negative, while the mining segment accounted for the bulk of the consolidated EBITDA. The 2H margin drop was even bigger as compared to 1H. Thus, in 2H19 Metinvest was unprofitable yet on an operational level. 2H19 EBITDA efficiency was only 7% against 15% for 1H19

- The group's net loss in July-December 2019 amounted to $67 mln

- Metinvest posted a negative free cash flow (FCF) for the first time in a long time amid lower operating cash flow (even taking into account funds released from working capital) and planned funding of the investment programme. 2019 capex increased by 17% to slightly over $1 bln, in particular, environmental capex (ESG) totalled $155 mln, allowing Metinvest to receive an MSCI ESG Rating of ‘B’

- At the end of 2019, total debt equalled $3.032 bln (+13%). The group raised gross new proceeds from eurobond offering completed in October 2019. At the same time, the proceeds were used to extend loans repayment schedules - over 80% of liabilities due in 2023 or later

- The group's net leverage grew markedly due to lower operating cash flow. Thus, the net debt/EBITDA ratio was estimated at 2.3x as of 31.12.2019 compared to 1x a year earlier

- Metinvest’s public debt consists of three issues of USD-denominated bonds and one Euro-denominated bond issue. The notes have been declining recently amid global flight to quality and concerns about further fall of commodity markets. We believe the released financial results may add pressure on the company's securities

Metinvest’s key financial results, IFRS

Sources: Company data, ITI Capital estimate