The Moscow Stock Exchange has upgraded the free float factor of Transneft preferred shares to 37%. This decision was made on April 16, 2020 following the Moscow Exchange Index Committee meeting.

The new indicator will be reflected in the Moex indices beginning from June 20, 2020. This move will support the company's shares.

MSCI Russian review will take place from April 17 to April 30. The number of Transneft preferred shares in free circulation used to calculate the index is 466462.5 (shares FIF Adjusted), or 30%.

Transneft weight in MSCI Russia is 0.54%.

Key points

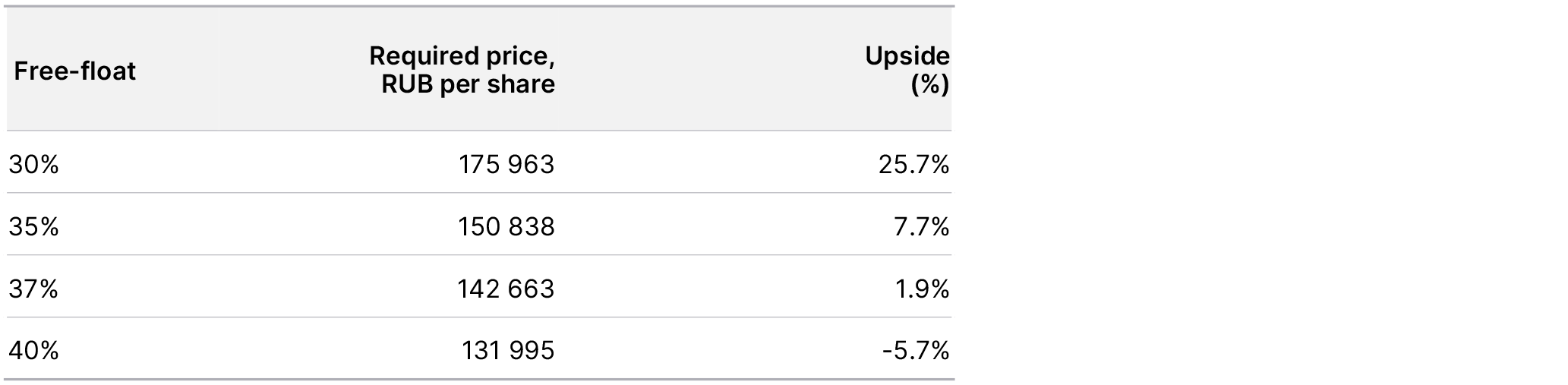

Transneft shares now trade at 140,000 roubles. We view the following scenarios as the most likely:

MSCI rounds up weight figures to the closest 5. Free-float capitalization - a condition of entering the index.

Source: ITI Capital

MSCI has traditionally been sticking to a conservative approach, which poses risks to Transneft shares. MSCI estimate of the number of Transneft preferred shares in free circulation may not coincide with that of the Moex or the adjustment process may take longer. Under this scenario Transneft shares may be excluded from MSCI Russia if the stock price doesn’t rise.